How Are Checks Secured with Secure Check Printing

| Team info | |

|---|---|

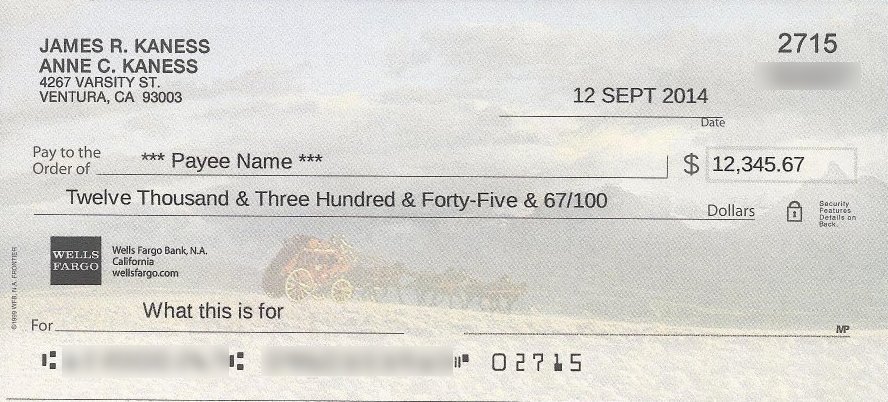

| Description | In a digital-first world, it’s easy to assume checks are outdated, but millions of businesses still rely on them. Whether it’s for payroll, vendor payments, or high-value transactions, paper checks remain a trusted method for transferring money. That trust, however, hinges on robust security practices, especially as fraud attempts grow more sophisticated. One essential tool in the fight against check fraud is secure check printing.  Secure check printing involves a combination of specialized equipment, secure facilities, and fraud-resistant features that make counterfeiting or altering checks significantly harder. It’s not just about printing checks with your office laser printer. Financial institutions and businesses use advanced systems to lock down every part of the process. Why Check Security Still Matters Checks account for a significant portion of fraud-related losses. According to the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN), Suspicious Activity Reports (SARs) related to check fraud increased from 350,000 in 2021 to more than 680,000 in 2022, nearly doubling year over year. This reality makes security an ongoing priority. It’s not just large banks that need to worry. Small and mid-size businesses often lack the internal controls that protect larger organizations, which makes them easier targets. Key Features That Secure a Check Modern checks look simple, but they’re embedded with layers of anti-fraud technology. These features don’t make checks immune to tampering, but they dramatically raise the cost and complexity for criminals. Here are a few of the most common: Microprinting: Words printed in tiny type that blur when copied or scanned. On a genuine check, they’re sharp and readable under magnification. Security borders: Intricate designs around the edges of a check that make alterations obvious if someone tries to tamper with it. Watermarks: These are visible when held up to the light, just like those on currency. Void pantographs: Background patterns that reveal the word “VOID” if someone attempts to photocopy or scan the check. Chemical protection: Paper treated to show visible stains if someone tries to alter information with solvents or bleach. Who Prints Secure Checks? Not every printer qualifies for secure check printing. The process is typically handled by certified check printing vendors who meet rigorous industry standards. These companies operate in secure facilities, limit employee access to sensitive areas, and maintain audit trails of every print run. When a business contracts one of these vendors, the printer often also takes care of storing blank check stock, maintaining security protocols, and integrating directly with accounting or payroll systems. This minimizes risk at every stage, from data input to physical delivery. The Importance of Positive Pay While secure printing prevents a check from being faked or altered, it doesn’t stop someone from stealing a legitimate one. That’s where “Positive Pay” comes in. It’s a fraud-prevention service where the check issuer sends the bank a list of checks they've issued, including check numbers, dates, and amounts. When a check is presented for payment, the bank matches it against the list. If something doesn’t match, the bank flags it for review. This extra verification step is one of the most effective fraud prevention tools for companies that write large volumes of checks. Digital Controls Matter Too Even the most secure physical check can be compromised if digital systems are vulnerable. Businesses should encrypt files sent to printers, restrict access to check-writing software, and implement multi-factor authentication wherever possible. Likewise, blank check stock should never sit on open shelves. It needs to be stored in locked cabinets or safes, with limited access. Printers used for check production should not be used for general office tasks, and logs should be maintained to track check numbers and output. Why DIY Check Printing is Risky Some businesses try to save money by printing checks in-house. That might be fine for low volumes if the proper precautions are taken, but it’s rarely as secure as outsourcing to a dedicated vendor. Risks include: - Improper storage of check stock - Unauthorized access to check templates or printing equipment - Lack of tamper-evident paper or ink - Limited audit tracking Plus, DIY operations rarely meet the same compliance requirements that professional check printers do, especially when dealing with HIPAA or financial regulatory standards. Legal and Financial Consequences of Check Fraud Fraud doesn’t just result in financial losses. It can lead to regulatory penalties, lawsuits, and damaged reputation. For example, if a healthcare provider’s checks are stolen and patient funds are misused, that could trigger a HIPAA violation. Or if a vendor receives a fraudulent check, that might damage a long-standing business relationship. Preventing check fraud is about more than security. It’s about maintaining trust, avoiding liability, and demonstrating financial competence. Best Practices for Check Security Whether you handle check printing internally or outsource it, here are some best practices to follow: - Use secure, MICR-compatible ink and printers designed for check printing - Limit employee access to check-writing systems - Implement Positive Pay or similar bank verification - Review all cleared checks regularly - Use pre-numbered checks and account for all of them - Never leave signed checks unattended It’s also smart to reconcile accounts frequently, investigate any anomalies immediately, and educate employees on fraud tactics. Why It’s Still Worth the Effort Some companies hesitate to invest in secure check printing, thinking the era of paper payments is ending. But as long as checks remain in circulation, criminals will continue to exploit weak points. Fortunately, advances in security features and printing protocols make today’s checks far more resistant to fraud than those of the past. When businesses take check security seriously, they protect not only their bank accounts but also their credibility. With financial fraud on the rise, the cost of complacency can be far greater than the cost of prevention. Secure check printing remains a critical tool in the broader strategy of business risk management. Security is a moving target, and checks are no exception. The more layered the defense, the harder it becomes for fraudsters to find a way in. |

| Created | 29 May 2025 |

| Total credit | 0 |

| Recent average credit | 0 |

| 14e credit | 0 total, 0.00 average (0 tasks) |

| 15e_small credit | 0 total, 0.00 average (0 tasks) |

| 15e credit | 0 total, 0.00 average (0 tasks) |

| 16e_small credit | 0 total, 0.00 average (0 tasks) |

| 16e credit | 0 total, 0.00 average (0 tasks) |

| Cross-project stats | BOINCstats.com SETIBZH Free-DC |

| Country | United States |

| Type | Local/regional |

| Members | |

| Founder | Kelly Wilson |

| New members in last day | 0 |

| Total members | 0 (view) |

| Active members | 0 (view) |

| Members with credit | 0 (view) |

Generated 18 Dec 2025, 21:25:49 UTC